On Tuesday, Hillary Clinton announced a new plan that will expand tax relief to families with young children. The plan is outlined in the following release from Hillary for America:

As part of her plan to build an economy that works for everyone, not just those at the top, Hillary Clinton is announcing today a new expansion of the Child Tax Credit for families with young children. She will double the Child Tax Credit to a maximum of $2,000 per child up to and including age 4, and she’ll expand access to millions more families. As many as 15 million young children will be eligible for the credit of up to $2,000 – and millions more people will benefit from additional relief. And this is only a down payment on further relief for middle-class families.

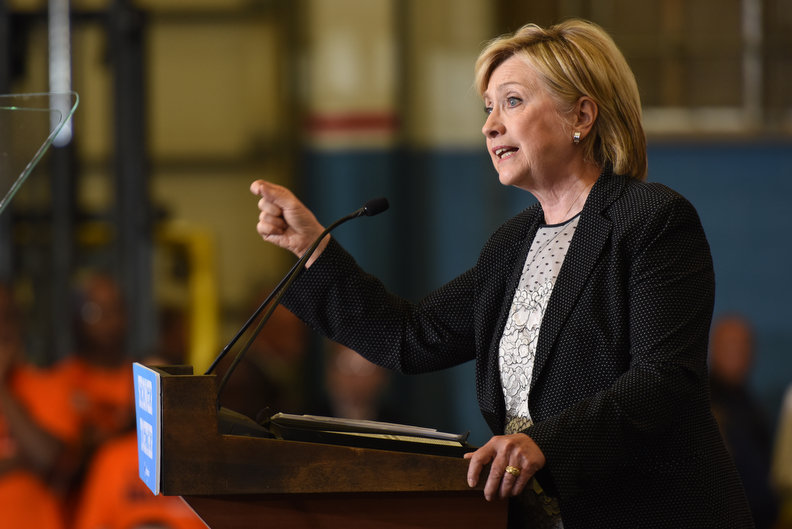

“Hard-working, middle-class families are struggling with rising costs for child care, health care, caregiving and college,” said Clinton. “This new tax credit will make their lives a little bit easier and help restore fairness to our economy.”

Clinton has previously announced middle class tax relief in the form of an up-to-$5,000 credit for families with excessive out of pocket health costs, and up to $1,200 for families caring for parents and grandparents.

Specifically, Clinton is announcing today that she will:

- Double the Child Tax Credit from $1,000 to $2,000 for each young child. Right now, the Child Tax Credit gives millions of families up to $1,000 per child each year to help cover all the burdens they face. Clinton will double the maximum credit to $2,000 for each young child up to and including age 4.

- Expand Child Tax Credit refundability so millions more working families get additional relief. Under our current system millions of families do not qualify for the full credit or get very little benefit because they simply do not make enough money, since the tax code excludes the first $3,000 in earnings in determining whether a working family is eligible for refundable relief. Clinton will lower the threshold for refundability from $3,000 to the first dollar of earnings for families with children of all ages, so every working family can benefit. And she will increase the phase-in rate to 45% from 15% for families with young children. According to the nonpartisan Urban Institute, the credit is structured so that families at the low end of the income distribution do not receive the full credit, and those families that are left out are more likely to be African-American and Latino. Improving refundability and increasing the phase-in rate will help close this gap and increase the overall fairness in the system.

- Provide further tax relief for middle-class families, including those without children, and with older children: Clinton believes we should go further than doubling the Child Tax Credit for young children. The expansion Clinton is calling for today is a down payment on her overall vision for tax relief for middle-class families. Clinton believes we should further expand the Child Tax Credit for families with older children, and expand refundable relief for low-income workers without children.

Clinton’s plan will be fully paid for by her proposals to ensure the wealthy, Wall Street, and big corporations pay their fair share. And like the current Child Tax Credit, it will phase out for higher-income families.

Refundable tax credits like the Child Tax Credit reward work, lift families out of poverty, and improve lifelong outcomes for kids. Studies have shown that the Child Tax Credit helps lift millions of Americans out of poverty each year. Not only does the Child Tax Credit help fight poverty for families in the year that they qualify for the tax cut, its effects can be seen for many years later. Parents in families that receive refundable credits like the Child Tax Credit are more likely to be in the labor force and contribute to the economy. Children in those families do better in school, are more likely to go to college and earn more when they become adults.

Clinton’s proposals to expand relief for hard-working families with children stand in strong contrast to Donald Trump’s plans. Because Trump’s child care and maternity leave plan gives far more to high-income families than middle-class families struggling with costs, and his tax plan rolls back dependent exemptions and other relief for parents with children, it would actually raise taxes on 8 million middle-class families to fund his tax cuts for the rich and multinational corporations, and $4 billion for his own family.

Specifically, hard-working families that get tax relief under Clinton’s plan would see tax increases, or a much smaller tax cut, under Trump:

- A single parent earning $75,000 per year, with two young children, and $8,000 in childcare costs would see a $1,640 tax increase under Trump, and $2,000 in tax relief under Clinton’s plan. A recent academic analysis found that compared to current law, Trump’s plan would raise taxes on this family by $1,640, because it eliminates personal exemptions and the head-of-household filing status. Clinton’s expansion of the Child Tax Credit would give them an extra $2,000 in tax relief.

According to the same analysis, a married couple earning $50,000 per year, with two young children, and $8,000 in childcare costs would get a $93 tax cut under Trump’s plan, and $2,000 in tax relief under Clinton’s plan.

For all the latest, follow our Scheduled Events page and follow Clinton on Twitter, Facebook, YouTube, and Instagram. Also, be sure to subscribe to the campaign’s official Podcast, With Her.

News Source: The Wall Street Journal