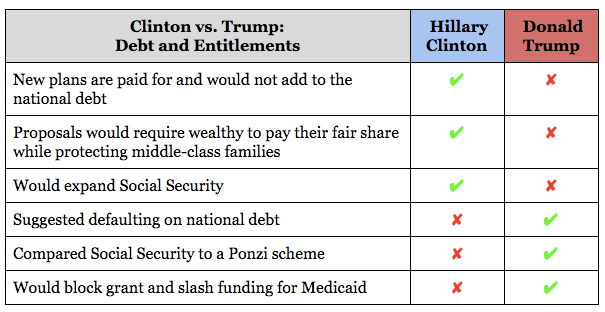

Clinton Will Fight For Medicare & Social Security, Pay For Her Plans; Trump Will Risk These Programs & Add Trillions To Debt

Tonight, voters will hear from Hillary Clinton and Donald Trump on six topics of national importance: debt and entitlements, immigration, economy, the Supreme Court, foreign policy, and the fitness of the candidates to serve as president.

Clinton has stood up for Medicare, Social Security, and Medicaid her entire career, and she will not stop now. She will ensure the wealthy, Wall Street, and big corporations pay their fair share, invest in middle-class families, and defend and expand Medicare and Social Security. Furthermore, her new plans are paid for, so they will not add to the national debt.

Conversely, Trump’s plans will add $21 trillion to the national debt over 20 years and give reckless tax cuts to the wealthy instead of investing in Medicare and Social Security for generations to come.

Hillary’s vision on fiscal matters is clear. As she has said before, “We know what sound fiscal policy looks like and it sure isn’t running up massive debts to pay for giveaways to the rich. And it is not painful austerity that hurts working families and undercuts our long-term progress. It’s being strong, stable, and making smart investments in our future. So let’s set the right priorities and pay for them, so we can hand our children a healthier economy and a better future.”

Hillary has put forward credible plans to pay for her proposals without adding to the national debt. As president, Hillary will:

- Continue to put forth plans that add up, are paid for, and will not add to the national debt. As the Committee for a Responsible Federal Budget said recently, “We are encouraged that Clinton continues to largely pay for her new spending…”

- Restore fairness to the tax code and make sure the wealthiest Americans pay their fair share. The independent, non-partisan Urban-Brookings Tax Policy Center found that around 2/3rds of the revenue from Hillary’s tax plan came from the top 0.1%, earning more than $3.7 million per year.

- NYT: “Mrs. Clinton would substantially raise taxes on high-income taxpayers, mostly on the top 1 percent; … reduce taxes on average for middle- and low-income households; and overhaul corporate taxes. Her plan would increase federal revenue $1.4 trillion over the first decade….Mrs. Clinton would use the money to pay for education and other initiatives.”

- Hillary has a responsible, progressive fiscal vision. Progressive policies such as investing in growth and the middle class, and asking the wealthy to pay their fair share – not trillions of dollars in tax cuts for the wealthy, have been successful. For example, President Bill Clinton took a $300 billion deficit in the year before he took office and turned it into a $200 billion surplus.

Hillary believes seniors have paid into Social Security for a lifetime, and they’ve earned these benefits when they retire. Social Security isn’t just a program—it’s a promise. As president, Hillary will:

- Defend Social Security against Republican attacks and attempts to privatize the program – and refuse to embrace proposals to raise the retirement age or reduce cost-of-living adjustments

- Expand Social Security for those who need it most and who are treated unfairly by the current system—including women who are widows and those who took significant time out of the paid workforce to take care of their children, aging parents, or ailing family members.

- Preserve Social Security for decades to come by asking the wealthiest to contribute more.

Hillary believes Medicare and Medicaid are the bedrock of health care coverage for more than 50 million Americans, from seniors to people with disabilities. As president, Hillary will:

- Fight to preserve Medicare benefits for Americans – and stand strongly against Republican attempts to “phase out” or privatize Medicare.

- Require drug manufacturers to provide rebates for low-income Medicare enrollees that are equivalent to rebates in the Medicaid program through her prescription drug plan.

- Reduce the cost of prescription drugs for seniors by allowing Medicare to use its leverage with more than 40 million enrollees to negotiate drug and biologic prices.

- Tackle rising medical costs by expanding value-based delivery system reform in Medicare.

- Help protect consumers from unjustified price hikes for long-available drugs.

- Ensure we expand Medicaid in the states where Republican governors and legislatures have refused to do so.

Donald Trump may have abused the tax system to avoid paying taxes into Social Security and Medicare – Hillary Clinton would help end this practice. Based on what we do know about Donald Trump’s tax returns, independent experts at the Tax Policy Center believe that Trump may have avoided paying his fair share in taxes into Social Security and Medicare by abusively taking advantage of the so-called “Gingrich-Edwards” loophole. This loophole allows some high-income business people to funnel their wages through a business. While the law still requires these business owners to pay payroll taxes on a reasonable portion of compensation, Trump may have flouted this legal requirement and avoided paying his fair share in payroll taxes that support programs like Social Security and Medicare. Earlier this year, Hillary Clinton embraced a proposal from President Obama’s budget that would end such abuses and crack down on tax gaming by high-income individuals through shifting business income, including addressing the so-called “Gingrich-Edwards” loophole.

Donald Trump’s tax plan would increase the debt by $21 trillion over 20 years to give tax cuts to the rich, and he has recklessly considered defaulting on the national debt.

- Trump infamously called himself the “king of debt” and has proposed a tax plan that would increase our national debt by 21 trillion over 20 years – with more than half of the benefits going to the top 1%.

- Trump displayed his willingness to play Russian roulette with the full faith and credit of the U.S., suggesting recently that “you could make the case” for defaulting on the debt, or maybe we could just “make a deal.” Defaulting on our debt would undermine more than 200 years of confidence in the American economy, and could cause a global financial crisis.

Paying for Donald Trump’s tax cuts for the rich could require cutting Medicare and Social Security by trillions:

- As an analysis by CAP Action explains, “Trump says his agenda ‘will be completely paid-for,’ but paying for his tax plan would require cutting federal spending by an average of approximately 13.5 percent. In the next 10 years, an across-the-board cut of 13.5 percent would mean cutting Social Security by $1.7 trillion and cutting Medicare by $1.1 trillion.”

Trump is willing to jeopardize Medicare, Medicaid and Social Security, which he once called a Ponzi scheme.

- Trump said “it’s possible” to replace Medicare.

- Trump wrote in his book that he would privatize Social Security and raise the retirement age, calling the program a Ponzi scheme.

- Trump’s campaign adviser suggested Trump would be open to looking at program changes to Social Security and Medicare.

- Trump’s running mate, Mike Pence, wanted to privatize Social Security faster and further than George W. Bush, and supported privatization in Medicare long before the Ryan Budget tried to voucherize it (which Pence also supported).

Trump’s plan to block grant Medicaid could cause millions of low-income adults and people with disabilities to lose or see lower benefits.

For all the latest, follow our Scheduled Events page and follow Clinton on Twitter, Facebook, YouTube, and Instagram. Also, be sure to subscribe to the campaign’s official Podcast, With Her.