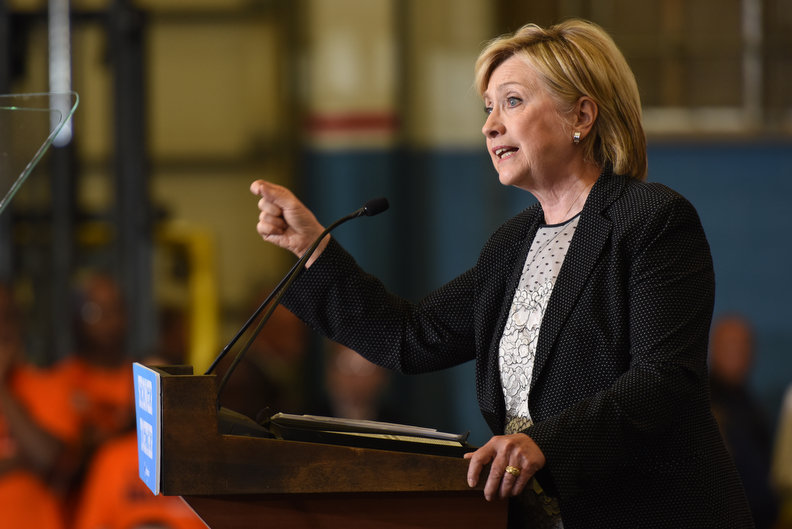

On Tuesday, Hillary Clinton announced a plan she would introduce as president to boost small businesses. She introduced her plan in an article for LinkedIn followed by a teleconference with members of the press and several small business owners. Clinton warned of Donald Trump’s past business practices with small businesses arguing that a Trump presidency would not be good for small business owners. The comprehensive plan builds on her overall economic plan which would create millions of jobs by investing in infrastructure upgrades and clean energy. Small businesses play into her overall plan as they will provide American workers and products. An outline of the plan is below and the full plan is available on The Briefing.

- Make it easier to start a business and become profitable

- Push states to make it faster and cheaper to start a business

- Working with states to standardize licensing requirements

- Making technical assistance and resources available to states

- Provide incubators, mentoring, and training to 50,000 entrepreneurs and small business owners in underserved communities

- Make it easier to get financing and find investors

- Streamline regulation and cut red tape for community banks and credit unions

- Harness the potential of online lending platforms

- Reduce the burden of student debt by allowing entrepreneurs to defer student loan payment

- Promote the 100% tax exclusion on capital gains for long-term small business investments

- Expand and streamline the SBA’s Small Business Investment Company program

- Support new innovative ways to assess creditworthiness for small business owners

- Expand access to credit in underserved communities

- Give the SBA administrator the authority to continue providing 7(a) loan guarantees to small businesses

- Expand access to working capital by expanding the SBA’s working capital guarantee programs

- Make it cheaper and faster to file taxes and pay for tax relief

- Work to create a new standard deduction for small businesses

- Allow 4 million small businesses with gross receipts under $1 million to take advantage of “checkbook accounting”

- Allow small businesses to immediately expense up to $1 million in new investments

- Quadruple the start-up tax deduction to significantly lower the cost of starting a business

- Make it easier to offer health care and other benefits to employees

- Simplify and expand the healthcare tax credit

- Allow more small businesses pool together to offer retirement plans

- Make it easier to work with the federal government

- Work to completely revamp the digital experience for small businesses

- Use the leverage of more than $400 billion in federal government contracting to encourage businesses to pay their suppliers in full and on time

- Guarantee a 24-hour response time to small businesses with questions about federal regulations and access to capital programs

- Ensure that Small Business Development Centers are placed in the highest-need communities with staff that speaks the language of local residents

- Work to ensure that federal regulations aren’t unnecessarily holding small businesses and our economy back

- Increase federal contracting opportunities for women-owned, minority-owned, and veteran-owned small businesses

- Defend and strengthen the Export-Import Bank

- Encourage small business exports by expanding SBA funding for export development

- Make it easier to fight back when you’re getting stiffed

For all the latest, follow our Scheduled Events page and follow Clinton on Twitter, Facebook, YouTube, and Instagram. Also, be sure to subscribe to the campaign’s official Podcast, With Her.

News Source: LinkedIn, The Briefing, Bloomberg, Forbes