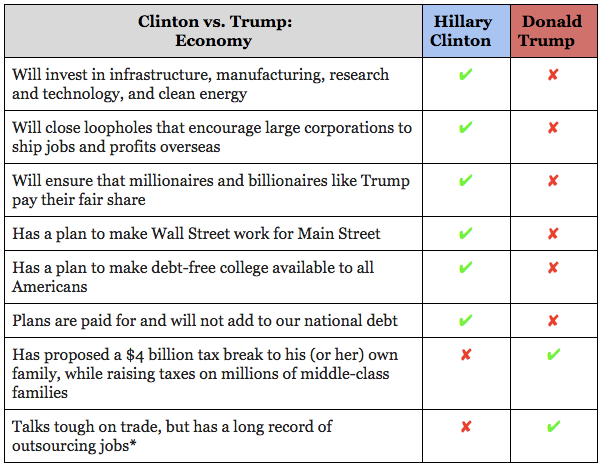

Under Clinton, Economy is “Stronger Together.” Under Trump, Economy is “Billionaires First.”

Hillary Clinton believes our economy is stronger when we grow together. She’s put forward a comprehensive agenda to build an economy that works for everyone, not just those at the top — fighting for the largest investment in good-paying jobs since World War II, debt-free college, profit-sharing, tax fairness, and family-friendly policies like paid leave. Donald Trump, on the other hand, has put forward an agenda that showers billionaires and millionaires like himself with trillions in tax breaks and new loopholes, recklessly exploding the deficit while actually raising taxes on millions of middle-class families.

When John McCain’s former economic advisor studied the two plans, he actually calculated that under Hillary’s plans the economy would create 10.4 million jobs in her first term alone—while Trump’s plans would result in a “lengthy recession” and a loss of 3.4 million jobs.

*Trump has outsourced his products to at least 12 countries and routinely picks Chinese steel over U.S. manufacturers.

Hillary Clinton believes we need to build an economy that works for everyone, not just those at the top. As president, Clinton will:

- Break through Washington gridlock to make the boldest investment in good-paying jobs since World War II

- Make debt-free college available to all Americans

- Rewrite the rules to ensure that workers share in the profits they help create

- Ensure that those at the top pay their fair share

- Put families first by matching our policies to how families live, learn, and work in the 21st century economy

Trump’s reckless agenda would shower billionaires and millionaires like himself with trillions in tax breaks and new loopholes, recklessly exploding the deficit while actually raising taxes on millions of middle-class families. Trump will:

- Enact a massive backdoor tax cut for billionaires and millionaires like himself, also known as “The Trump Loophole.”

- Widen the “carried interest” loophole by slashing tax rates on partnerships, including hedge funds and private equity firms.

- Get rid of the Wall Street reforms enacted after the recent crash, removing protections for consumers.

- Eliminate the estate tax, resulting in a $4 billion tax cut for his family alone — while giving 99.8% of Americans nothing.

- Actually raising taxes on millions of middle-class families.

Run up the national debt by nearly $21 trillion over 20 years.

For all the latest, follow our Scheduled Events page and follow Clinton on Twitter, Facebook, YouTube, and Instagram. Also, be sure to subscribe to the campaign’s official Podcast, With Her.